Whether you’re new to the field or just looking for some clarification, you may find yourself asking, “What exactly is programmatic?”

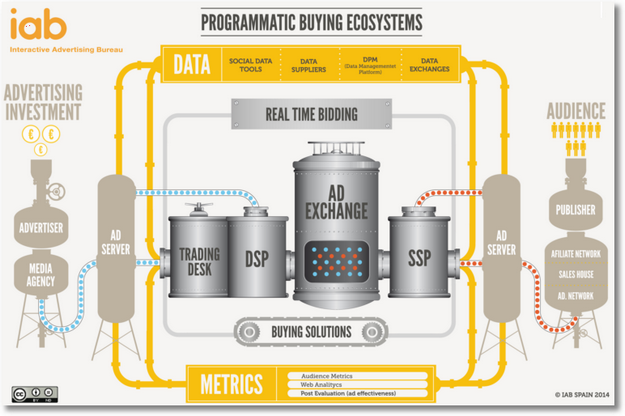

In its simplest terms, programmatic advertising is defined as the automated buying and selling of online advertising space. But, the inner workings of it are much more complex.

Programmatic is the fast-growing, computer-based automatic buying, selling, placement and optimization of digital advertising. In contrast with traditional media buying, programmatic buying involves the use of software to purchase digital ads in real time. Its auction-based technology ensures efficiency and scale at a reduced advertising cost.

This technology uses algorithmic software that handles the sale and placement of digital ad impressions via ad exchange platforms in a fraction of a second. It also incorporates traffic data and online targeting methods to serve impressions more accurately, efficiently and at scale, which means better ROI for advertisers and publishers alike. Programmatic exists for many digital media channels, including display, mobile, video, social and digital out-of-home.

- A person clicks on a website

- The website owner puts the ad impression up for auction (SSP)

- Advertisers offer bids for the impression (DSP)

- The highest bidder wins the ad impression

- The ad is served on the website to the user

- Ideally, the user clicks on the ad and converts

This all happens in an instant! This particular method is referred to as Real-Time Bidding (RTB) and is one of the most common forms of programmatic advertising. More on RTB below…

Types of Programmatic Advertising

- Real Time Bidding (RTB) – RTB is a way of buying and selling ads through real-time auctions, meaning transactions are made in the time it takes to load a webpage; around 100 ms. Advertisers buy inventory on an impressions-by-impressions basis. One main advantage of RTB is that advertisers can purchase impressions from multiple publishers together instead of dealing with them individually. As a result, advertisers can reach their target audience more precisely and bid accordingly based on what they know about the website and user at that particular time.

- Programmatic Direct – Also known as programmatic guaranteed, programmatic reserved or automated guaranteed, programmatic direct involves advertisers buying inventory directly from publishers via ad servers and ad networks. There is no auction involved, so it uses a fixed-price agreement. Programmatic direct deals can include guaranteed and non-guaranteed contracts. It is usually used for large “premium” formats like full-page takeover ads. Although ad placement is assured on specific publisher sites, there is less opportunity to fine-tune audience targeting.

- Private Exchange or Private Marketplace (PMP) – This is a variation of the RTB model which allows publishers to offer their premium inventory to a selected number of buyers. Unlike RTB where advertisers can buy a publisher’s inventory in an open auction, PMP is invite only. Advertisers interested in a publisher’s premium inventory can reserve or guarantee their ads before the publisher offers them in an open RTB auction.

What is an Ad Exchange?

An ad exchange is an all in one platform where advertisers meet publishers and agree on a price to display their ads. Think of it as the trading floor of the stock market. Using an ad exchange usually has great benefits for both publishers and advertisers, as it means access to a broad selection of websites or other digital channels, and a big pool of advertisers too. It is in the middle of the programmatic ecosystem and is plugged into a Demand Side Platform (DSP) on the advertiser’s side and a Supply Side Platform (SSP) on the publisher’s side.

In the beginning, it was used as a way for publishers to auction off their unsold inventory to the highest bidder, after having sold their premium inventory manually. However, with the rapid growth and success of programmatic, it is now used for all inventory.

What are DSPs and SSPs?

- DSP stands for demand-side platform. A demand-side platform is a tool or software that allows advertisers to buy ad placements automatically. It’s the advertiser’s tool to help organize ad buying. It enables advertisers to target certain audiences via data such as location, age, previous online behavior and more.

- SSP stands for supply-side platform. A supply-side platform is used by publishers to manage, sell, and optimize their inventory (aka ad space). SSPs enable publishers to monetize their website and mobile apps by showing ads in display, video, and native formats to their visitors. Some SSPs vendors can connect to DSPs directly instead of connecting to an ad exchange first.

Recap: Someone visits a website. If the website is connected to an SSP, the SSP sends a signal to the ad exchange indicating the placements and formats it has available. The exchange then asks the DSP if the advertiser has any ads that might fit the placement. If it does, the DSP sends a signal to enter a real-time bidding auction together with other advertisers to compete over the placement. The winning bidder gets to show his ad to the website visitor.

What is a DMP?

Is your head hurting from all the acronyms yet? DMP stands for Data Management Platform. A DMP collects, stores, and organizes data gathered from a range of sources such as websites, mobile apps and advertising campaigns. Because DMPs collect huge amounts of data from a range of sources, advertisers and agencies use them to improve ad targeting and create advanced analytics. Basically, the DMP it used to sort data and fuel decisions, which informs the DSP how to handle the actual ad buying. A DSP on its own cannot make informed decisions on where to buy ad space.

Publishers can also use a DMP to view detailed reports about their audience and inventory, sell their data to advertisers and data brokers and offer their audiences to advertisers outside of their website via audience extension.

Benefits of Programmatic

- Reach

- Transparency

- Targeting

- Real Time Optimization

- Relevancy

What’s New In Programmatic?

Programmatic advertising is becoming more powerful with each passing year. And the pandemic has not hurt it. In fact, maybe it has helped. This year, it’s anticipated that almost 88% or $81 billion of all US digital display ad dollars will be transacted programmatically, according to eMarketer.

So what are some new trends in the programmatic world? In what areas will we see growth? What do we need to know to have a successful programmatic strategy in 2021?

If you are part of the marketing or media buying department for your company, not all of these might fit your business plan. But that’s ok, because there are more opportunities and variety than ever.

Connected TV (CTV) and Over-the-Top (OTT) Services Will See Massive Growth

This area is perhaps the most unstoppable. OTT and CTV basically go hand-in-hand, as OTT refers to the streaming services we use to watch content, like Netflix and Hulu. CTV, however, refers to the actual devices used to access these services, like Apple TV, Roku and Amazon Fire Stick.

But let’s start with CTV. The the increase in CTV users is so significant that a forecast by eMarketer predicts by the year 2022, the amount of connected TV users in the US will grow 204.1 million, which is more than 60% of the country’s population.

Programmatic advertising on CTV works really well for several reasons. First, the ads are very, very targeted. You can reach people on specific platforms, devices, services and demographics directly, with a high ad completion rate. Second, the ads use video,which can be highly engaging and persuasive. Also, the ads have high completion rates because people are willing to stay with the ad to continue watching their program.

The amount of connected TV users is also continuing to grow, which in turn is causing a significant increase in programmatic TV advertising. According to Comscore, over-the-top (OTT) streaming services like Netflix, Hulu, and others have added 20 million households in the past four years. Another impressive fact: 62 million homes used OTT this past year, with 67% reach across homes with WiFi installed. With this growing customer base, we are also seeing more and more streaming services being launched.

Surprisingly, growth in the reach of ad-supported OTT services is growing faster (+7% YoY) than their non-ad counterparts. This includes more than just media services, such as Hulu. New OTT video conferencing, chat, phone and even household and commerce solutions are finding strong footholds in the market as well.

Don’t Forget Mobile

OTT makes for a great segue to the prominence of mobile for digital advertising. Smartphones and tablets are the viewing media of choice for so many consumers. From watching Netflix shows on the go to browsing videos on YouTube and various social media channels, it’s no wonder that mobile has a 68 percent share of digital ad spending, according to eMarketer.

Yet, in this case the pandemic has impacted mobile ad spend, causing spending trends to fall short of pre-pandemic forecasting. The aforementioned rise and viability of CTV must also be considered, which could cut into the share of mobile ad spend. Still, more and more people are putting smartphones in their pockets, with total global smartphone users to grow to 3.8 billion by 2021, up 300 million from 2020 estimations.

Live Video Streaming Going Strong

Live streaming is becoming more popular than ever. Users are now watching more diversified video content in real-time generated by both professional and non-professional content creators. According to ResearchAndMarkets.com, back in 2018, the estimated global Live Video Streaming (LVS) market size was around $8.25 billion. The global LVS market is projected to reach $22.09 billion by 2022.

Digital Out of Home Targeting Will Keep Improving

The digitization of out-of-home advertising has greatly increased its ability to be effective, particularly in comparison to the old fashioned billboards of the past. These new outdoor digital screens are increasing in popularity due to their potential for programmatic advertising. DOOH offers an exceptional ability to reach consumers with situation-specific messages. Using environmental triggers, marketers can deliver relevant content to consumers with dynamic creatives based on date, time, location and real-world behaviors. The worldwide DOOH market size is projected to grow to $15.9 billion by 2027.

Wearables Will Be a Game Changer

Another opportunity for programmatic advertising that marketers have their eyes on is wearable technology. Nowadays, it seems as if everywhere you look there are people with wearable technology, such as smart watches or fitness trackers. Research suggests that the number of users will only continue to grow.

The size of the global wearable technology market is projected to increase at a compound annual growth rate of 15.9% from 2020 – 2027. The rise of wearable tech offers marketers a great new medium to implement programmatic advertising. Their ability to not only deliver content, but to collect data such as location, health metrics, and lifestyle choices makes it one of the most intriguing media buying trends in 2021.

Smart Audio and Voice Advertising on the Rise

Another form of technology that is seeing massive growth is voice-controlled devices. A 2020 consumer survey from voicebot.ai showed that as of January 2020, 87.7 million US adults were smart speaker users – this is up 32% from the same time the year prior. And these devices are increasingly being used for new activities, drawing the attention of marketers from around the globe. A report by NPR and Edison Research showed that 57% of smart speaker owners have used their devices to shop and 25% of stated purchases totaled more than $150.

Podcasts For All

There seems to be a podcast for everything. Podcasts have become a medium of choice for digital consumers and thus, an essential part of omnichannel digital ad strategies. Like OTT and CTV, podcasts represent a big and ever-growing audience. According to Statista, total US podcast listeners is expected to increase by 20 million over the next two years, to surpass 160 million in 2023. The variety, quality and availability of podcasts make this a highly appealing digital experience for modern consumers. Additionally, 49% percent of 12-34 year olds listen to podcasts, indicating the preferences of this young, tech savvy demographic. This option could be of particular interest to you if you are trying to target that age group.

One Small Caveat…

Some industry folks have concerns about recent privacy and data regulations, arguing that they have to potential to disrupt programmatic advertising as it currently operates. But don’t fold your cards just yet. As you can see, by the multitude of available options, the industry has a way of constantly evolving to meet the needs of the market. It will be interesting to see how things unfold, but I still think the unstoppable growth in the areas discussed will present many opportunities.