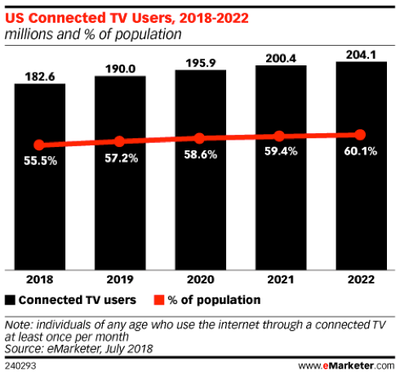

As shifts in consumer viewing habits continue, Connected TV (CTV) users account for approximately 182.6 million people in the US, over 55.5% of the population this year. US consumers have continued to embrace cord cutting, digital streaming services and adopt on-demand experiences of accessing content when, where and more specifically how they want. The popularity of Hulu, Sling TV, Roku, DirecTV Now and similar providers illustrates consumers desire to have more control when it comes to the content they want to engage with. For the marketer, reaching streaming audiences is made possible by CTV.

Streaming internet services and major network and broadcast providers like NBCU, ESPN, Turner and Warner etc. are realizing opportunities to tap into additional ad revenues. This gives them the ability to further permeate the digital and programmatic space as traditional TV investments adapt to changes in strategy and capture consumer dollars and audiences. Some

services, like Hulu, have been digital-first from the start, while others such as DirecTV and traditional network/broadcasters have altered their business models from a much more traditional model.

| Things to Know |

Over-the-top (OTT)/Connected TV (CTV): Content transported from a video provider to a connected device over the internet outside the closed networks of telecom and cable providers.

- It offers the power of digital advertising combined with an engaging, big screen user experience.

OTT leverages “apps” to stream video content to a television via an internet connection. Viewing methods include:

- On-demand – where viewers select and watch content whenever they wish.

- Linear/live – where viewers watch at a particular time, channel or app (live content is streamed in real time as the event happens).

The above references: IAB CTV Primer (Link below)

CTV, like any other digitally transacted format, is sold in a real-time environment, as an impression. Today, it can be purchased programmatically through guarantees, the open auction or private marketplace using your preferred marketing automation software platform. It is a 100% viewable environment and a safer bet when it comes to fraud given the nature of user authentication required when accessing content provider and your device. Now, with deeper technology integrations, advertisers can onboard their own 1st party data and utilize 3rd party audiences, making CTV further addressable and relevant.

Still, significant concerns such as nuances around ad frequency and viewer experience have been recognized as almost mainstream and undoubtedly troublesome. Seeing the same ad two times in a row, might lead to ad recall. However, it is not a positive viewer experience, something most streaming service users have dealt with. This has been top of mind for advertisers, networks, digital MVPDs and streaming providers. It is most directly attributed to attempts at scaling campaigns (from a tech capacity, it is associated with server-side ad insertion), making it essential to set up your campaign while taking a strategic approach.

This includes frequency capping to ensure that at a household level your target audience will only see an ad a given number of instances over a specific time period. Additionally, negotiating with CTV publishers directly regarding what ad slot(s) you are buying on a given application, including an understanding of the content your ad is being run adjacent to and length of that content will impact the overall outcome of your campaign. Working with your technology platform of choice also allows for appropriate targeting and day parting which supports successful campaign activation and are important areas of due diligence and planning.

Advertisers are continuing to seek more control in the programmatic buying processing as access to premium, transparent, direct inventory is of critical importance and has become more competitive. As CTV demand continues to rise, advertisers are more often working directly with publishers, including those selling premium CTV inventory; movement away from open auction transactions towards 1:1 private marketplace deals have become the norm. According to supply side experts, expectations are this migration will continue through 2019.

As CTV investment continues to develop, so will adoption of streaming devices (approx. 204.1 million CTV users by 2021) allowing savvy digital marketers an opportunity to get creative with messaging and engaging with customers directly through their television set.

Call to actions leading to interactive branding capabilities and engaging content will bring about shoppable experiences, allowing for true ROAS optimization and audience reach like that of today’s digital experience. Marketers should push the envelope with CTV, which in the end is internet enabled television. With continued innovation, the opportunity exists to make Connected TV as addressable and experiential as the marketer desires because of its relevance, continued addressability, and connection to consumers cross-channel digital behavior. Further, we can make it an experience worth consumers time to engage in, while gaining meaningful learnings, something that is at times is forgotten in programmatic.

Learn more about Advanced TV Targeting through the IAB primer including best practices for advertisers by visiting or eMarketer below:

https://www.iab.com/wp-content/uploads/2018/02/TV-Targeting_08082018.pdf