Believe it or not, back to school shopping is underway. Yes, it is true that many colleges and school districts are now out for summer. But some parts of the US still have a month or more to go. What is sparking this change to the traditional back to school shopping season? Why are many consumers shopping before kids are on summer break?

The back to school shopping season has long been the second biggest shopping period in the US and typically takes place in the summer months. Parents and others responsible for making these purchases usually don’t start until the previous year has wrapped up. But, according to recent research by Quantum Research, a good portion of the school-going population is getting a jump on purchases ahead of time.

First of all, it’s interesting to note that, now, online shopping doesn’t really seem to slow down anytime of the year. There is a brief lull after the holidays, but traffic and conversion rates quickly rise again to near holiday levels. We all know how the convenience of online and mobile shopping makes it so easy for consumers to shop anywhere and anytime.

But there may be another reason for taking early action. There are still concerns about supply chain issues and items being out of stock. According to the research, 29% of shoppers say inventory concerns have caused them to shop for items at least a month before they need it. This is true for every commercial holiday on the calendar. For back to school items, in particular, consumers are buying even earlier. In fact, 41% have either already started or plan to start before this school year even wraps. Comparing traditional K-12 shoppers to college shoppers, we see that those looking for college essentials are more likely to start earlier.

Inflation is also playing a role in this changing consumer behavior. With higher prices on everything, consumers are taking more time to plan their shopping. Findings show 76% of consumers say they are starting their shopping earlier, so that they can identify items they want and wait for them to go on sale. Three in four consumers (74%) also plan to make multiple purchases at once to ensure they keep to a budget. Moreover, a third of consumers (31%) say they’ve occasionally shopped on tax-free weekends in the past, but in the face of higher prices will make a point to take advantage of them this year. Almost one in three (28%) consumers who have never shopped on a tax-free weekend say they will participate this year.

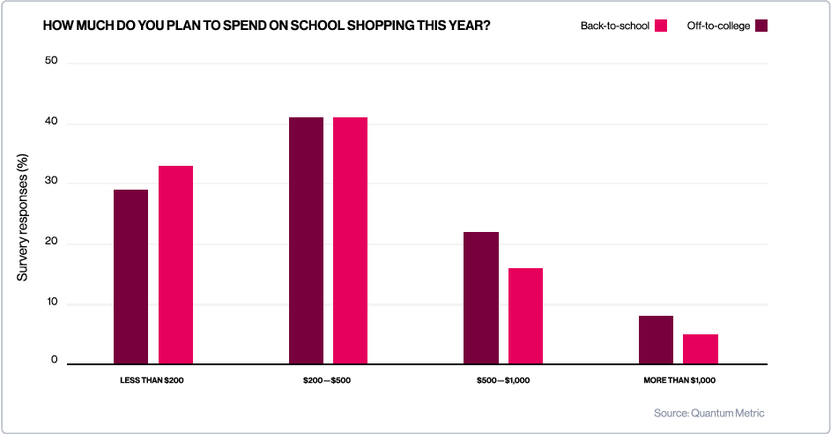

And how much are people expecting to spend? Most (41%) consumers expect to spend up to $500. One in five (21%), even plan to spend up to $1,000 or more on school supplies. This is quite remarkable when you consider it is the same amount some consumers budgeted for the holiday season. It’s also more than what some consumers might spend on a vacation (49%), home improvement projects (47%) or yearly purchases for themselves (64%).

Although consumers are willing to spend the money, they are still being selective about where they are making their purchases. Price checking is the norm. During the holiday season, 72% of consumers admitted they use their mobile phone to check for lower prices on an item while they are in the store. When it comes to big ticket items, more than half (55%) admit they are checking multiple retailer’s prices before making a decision.

As consumers think more about how they will shop as COVID restrictions ease, 48% say they will still primarily shop online. That doesn’t mean brick-and-mortar stores won’t be part of their shopping experience. One in five consumers (18%) will do their research online before buying in-store. Looking at online shopper engagement rates, we see mobile rates are twice that of desktop. From this, we can infer that consumers are spending time doing quick research while either in-store or about to head into a store.

But getting back to desktop, one area where desktop really thrives is in long-term researched, high-priced items. Half of consumers say they prefer to shop for big ticket items on desktop versus mobile, and average order values over the past few months corroborate this. Looking at how cart values have changed, we see that desktop has even experienced a spike in high value purchases in the new year. It seems that consumers prefer to use desktop when there is no time crunch or deadline. So in these early stages of back to school shopping, we may in fact see an uptick in desktop rates. No one is in a rush yet.

One battle for retailers this season will be cart abandonment. During the holidays, we saw higher than average abandonment rates and those rates will probably rise again as we move into the back to school shopping season. Perhaps this can be attributed to the growing popularity of building wishlists. It’s easy to put every want or need on a list, but then forget to follow up or find a better price elsewhere. Consumers who choose not to join a retailer’s loyalty program or create an account, are putting their ideal purchases directly in their shopping cart and waiting to make their purchase. And even though there is such an early start to shopping, actual school supplies seem to be of the lowest priority. Interestingly, 26% of consumers say they are most likely to wait to purchase general classroom items until the very last minute.

To recap, retailers need to understand that consumers will be doing back to school shopping on their own terms. It may be done early or it may be done late. It may be done via mobile or desktop or in-store. So it’s all about the hybrid experience and ensuring you have seamless options for your customers. And considering the back to school shopping season is now longer than normal, it allows more time to follow up on abandoned shopping carts and unfulfilled wishlists. When done with a sense of meaning, personalization and empathy, it will ensure a loyal relationship for many back to school seasons to come.