The 2019 holiday shopping season already seems like a distant memory. But, we promised we’d give you an update on all the facts and figures after the final data was in. So, here it is!

Let’s start with the overall numbers. Total retail spending was up 3.7% from 2018 to $1.007 trillion, marking the first-ever trillion-dollar holiday season. It is encouraging to see this kind of growth from the previous year, especially since we had a significantly shorter window of time between Thanksgiving and Christmas.

E-commerce on its own saw even more growth. According to the National Retail Federation, online and other non-store sales were up 14.6 percent over the year before, coming in at $167.8 billion. Much of this spending came from the massive use of mobile devices, which continues to rise as the channel of choice for consumers’ purchases. Button Mobile’s Commerce Report states that we saw a 68% increase in overall mobile spend per shopper, a 38% increase in total number of orders per shopper, a 106% increase in total number of installs and a 12% increase in overall conversion rate.

In addition, mobile shoppers continued to get more comfortable shopping via apps. Over Cyber Week, apps outpaced mobile web when it came to conversions (+86%) and orders per customer (+27%). App installs were 46% higher over the holidays compared to the rest of 2019. Consumers seem to know where they want to shop, without doing a browser search first. With these numbers, it is pretty clear that retailers need to focus on ways to get consumers to go straight to their apps or mobile sites in 2020. Simply put, shopping via mobile is the new norm.

Which categories were the winners? Reports of overall category spending vary, but a few common trends have emerged. Growth in apparel stayed relatively flat, while electronics, appliances, jewelry and home furnishings showed modest growth. However, MasterCard’s Spending Pulse Reportoffered an interesting insight on department stores, which have been struggling in recent years. They did see an overall sales decline of 1.8%, but an online sales growth of 6.9%. This once again emphasizes the importance of online/mobile and omnichannel options in general.

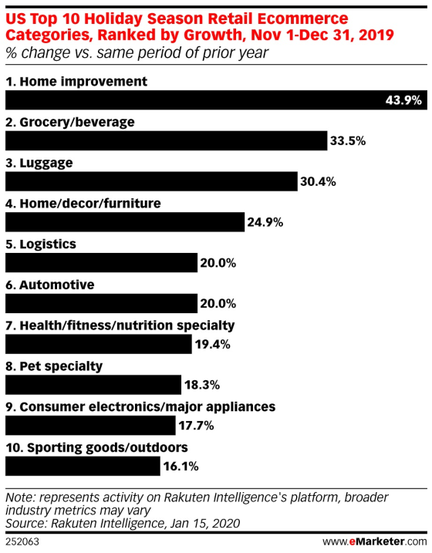

Ecommerce was really where we saw big surges in growth. Rakuten shared their top 10 categories:

As far as specific products, the Button research found that the Instant Pot 6-Quart Pressure Cooker reigns as the most purchased product of the 2019 holiday season. This is followed by Apple AirPods in second place and LEGO Classic Creative Fun Building Kit in third place. As for the most popular purchases by vertical, electronics, fashion, and office supplies dominated the retail category while NBA, NHL, and NFL tickets were the hottest items in the entertainment category.

And how did specific retailers fare? We’d be remiss if we didn’t start with Amazon, who unsurprisingly led the way among e-commerce retailers in traffic in December with 214.8 million unique visitors, up 4% vs. the prior year, according to Comscore. Walmart remained a strong No. 2 with 138.3 million (up 5%), while eBay rounded out the top three with 106.9 million (down 2%).

While many retailers, like Macy’s, Kohl’s, JC Penney and L Brands (Victoria’s Secret, Bath & Body Works) saw a decline in sales, some other retailers did see an increase. Target’s sales increased over the November & December time period, which may be due in large part to the shop online and pick-up in store option. For Target specifically, customers choosing the buy online/pick up in store option, curbside pickup, or same-day delivery increased more than 50%. Walmart also had a lot of success with their click and collect service, as well. This trend is certainly here to stay. Not only is it appealing to customers, but it also has the potential to drive sales in-store with the increased foot traffic.

We all know that it’s never too early to begin strategizing for the holiday season. Now that we can fully examine what worked and why it worked, businesses can take those lessons and apply them to this year’s plans. However, it should be noted that total retail spending for the 2020 holiday season is expected to grow only 3.4%. This is slightly less than the 3.7% growth seen this year and reflects signs that the consumer economy is weakening.