Will the back to school shopping season be a boon or bust for retailers?

Well, it depends who you ask.

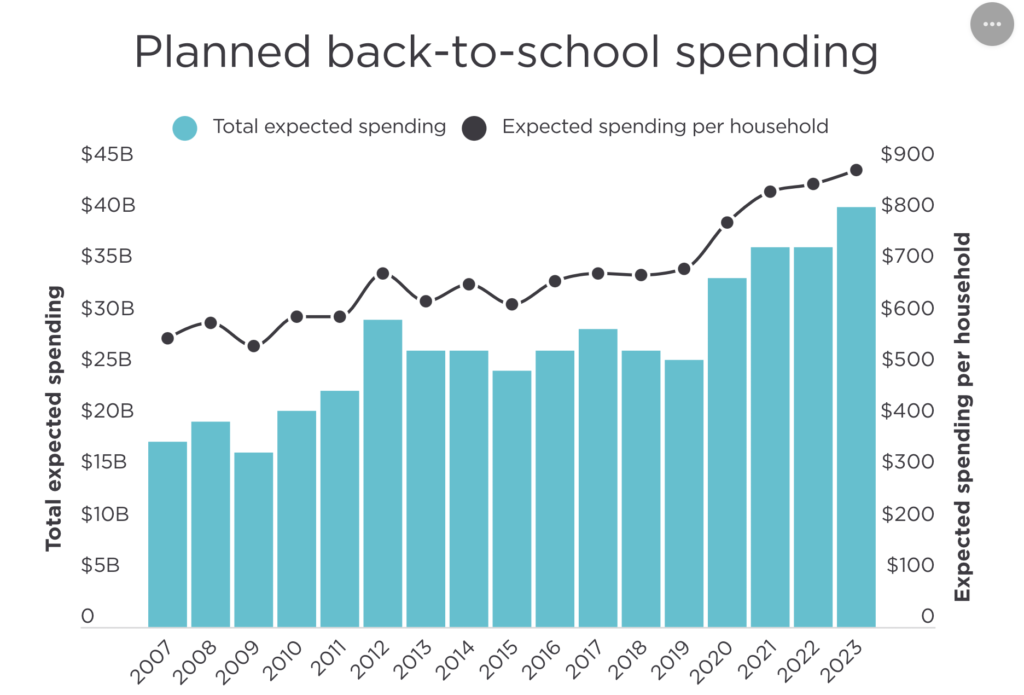

According to the annual survey released by the National Retail Foundation and Prosper Insights & Analytics, back-to-school spending is expected to reach an unparalleled $41.5 billion. This is up from $36.9 billion last year and the previous high of $37.1 billion in 2021. Back to college spending is expected to hit $94 billion, about $20 billion more than last year’s record.

Though there is variation for back to school dates across the country, shopping still started fairly early. As of early July, more than half (55%) of consumers who are buying for back to school said they have already started shopping. This is on par with last year, but is up from 44% in 2019, and is in line with the trend of consumers shopping earlier for major spending events. While consumers have started shopping early, as of early July, 85% said they still have at least half of their shopping left to do.

Families with children in elementary through high school plan to spend an average of $890.07 on back-to-school items this year, approximately $25 more than last year’s record of $864.35 and a new high.

Yet, other reports claim shopping for back to school essentials will be a bigger struggle for families this year because of inflation.

A new forecast from Deloitte says back to school spending by parents with children in grades K-12 is expected to decrease 10% this year over last year to $597 per student. The last time Deloitte expected a decline in back-to-school spending was in 2014. Figures for college students were not included in this report.

However, what’s interesting is purchases of school supplies are actually expected to be up 20% compared to last year. The report said spending on clothing is expected to fall 14% year-over-year and technology-related purchases are forecast to decline 13%, which is where the overall decline comes from. The takeaway here is that parents are prioritizing the necessities due to a reduction in disposable income.

But getting back to technology, the wide swing in expectations for technology-related purchases helps to explain the significant discrepancy between the NRF and Deloitte models. Where Deloitte expects a 13% decline, the NRF expects big-ticket electronics purchases will fuel growth because 69% of respondents to its survey expect to buy electronics or other computer-related accessories this year.

Both studies agree, however, agree that shoppers are likely to prioritize retailers with competitive pricing and attractive deals. “Even though consumers plan to spend more on school and college-related items this year, they are still looking to find the best value and deals,” Prosper Executive Vice President of Strategy Phil Rist said. “Consumers are stretching their dollars by comparing prices, considering off-brand or store-brand items, and are more likely to shop at discount stores than last year.”

Yet, there is one possible silver lining for retailers, according to Deloitte. Despite keeping an eye on the budget, nearly six in 10 parents are willing to splurge for the right reasons, like treating their child, self-expression, or better quality. Clothing/accessories and tech products are the top categories that may drive splurge spending. Retailers that can understand the drivers of splurging may be able to capitalize on those willing to part with a little extra cash.

We will be back with an update after the back to school shopping season is over to recap how everything actually pans out.

Image by Freepik