We’ve looked at the overall landscape (Part 1) and what is happening with the extremes of streaming and radio, (Part 2) but we haven’t touched on the digital OGs of search and social.

Can you believe that we are still on the same Facebook that we were on in 2004? What’s even scarier is that we’ve been “Googling” since 1998.

As a strategist, the idea was always to have SEO active within a campaign. The idea is that a consumer will turn to Google to find a client/product, so not putting money into SEO meant that you didn’t want to find clients. It is still a channel that doesn’t always require a lot of money, but it certainly does require a lot of attention.

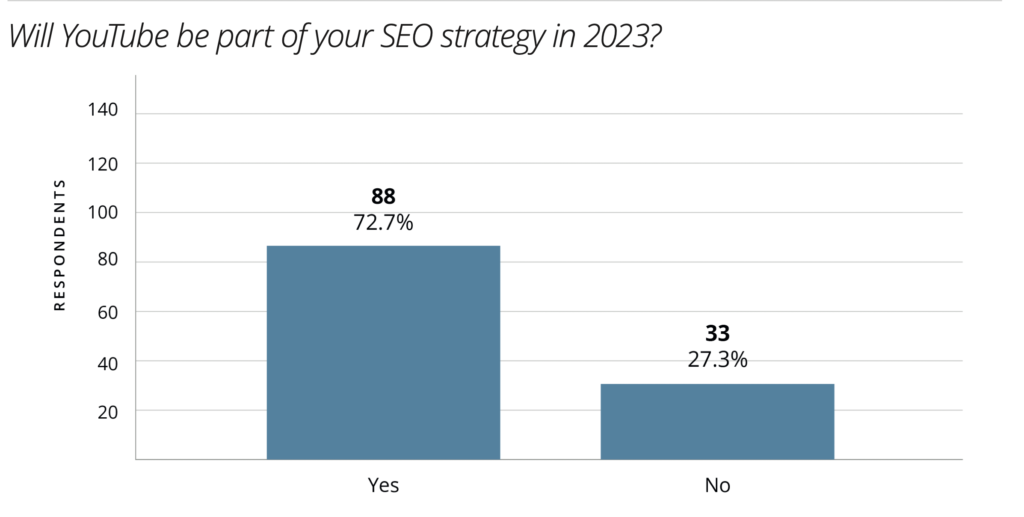

It boggles the mind how we are seeing a decline of 3% in overall spending within the channel. There is a growing shift of SEO moving from traditional search engine to YouTube, as many brands and clients are turning to video content to drive eyeballs. Unfortunately for SEO, that shift in dollars becomes its own line item on the balance sheet, which means a loss in dollars for the old reliable.

Speaking of old, Facebook and the other social platforms aren’t exactly pulling in the dollars that they once did. Gone are the days of first tests across social to gauge what the interest was before the eventual full-throttle roll out. Shifts in average age across the different platforms has made clients and agencies rethink how they are spending their ad dollars depending on what the goals of the campaign are.

Chances are these changes in age and consumption have led to the 6% decline in ad spending during Q1. It seems like it is just easier (and less of a deterrent) by pulling money out of this channel while still holding an audience.

Here’s to hoping that our Q2 recap paints the world in a rosier color, but who knows at this point?

Image by stockking on Freepik