Physical, brick-and-mortar stores are in a bad way right now. Although retail shopping is down in general, we have been seeing larger than expected growth in ecommerce due to the pandemic. Brands that can capitalize on new opportunities offered through digital and social shopping experiences should be in good shape. But is there any hope left for the brick-and-mortars? Especially the ones that truly thrive on the in-store experience, like Wal-Mart and Target. What will it take to get shoppers back in the stores again?

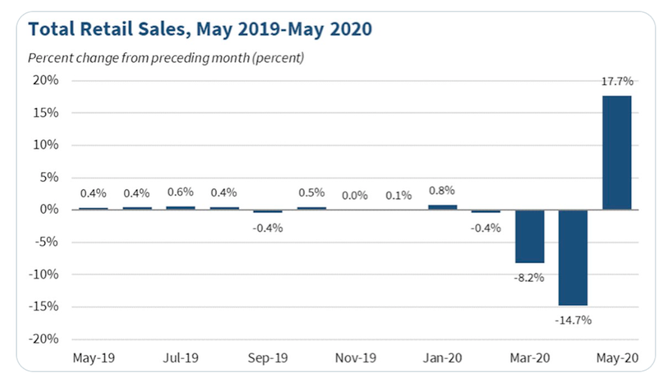

Retail sales plunged 16.4% in April, according to the Commerce Department. This was double the 8.3% drop in March and the biggest month-to-month decline since record-keeping started in 1992. “April was the month when large parts of the retail economy simply ground to a halt,” Neil Saunders, managing director of GlobalData Retail, wrote in a note. There was an encouraging rally in May, with a 17.7% rebound, but the month’s performance was still down 6.1% from last year. And experts say that the surge is likely short-lived, with full recovery possibly taking up to 5 years.

Coresight Research predicts 20,000 to 25,000 stores will shutter their stores permanently this year, and about half of those closures will be in malls. This is a dramatic increase from the pre-pandemic estimate of 15,000 closures and the 9,000 closures that actually happened in 2019.

This leaves the future of the mall in serious jeopardy. Malls have long been on the brink of demise with the rise of online shopping. However, the pandemic is definitely accelerating the downfall for several reasons. For one thing, malls were meant to create “shopping discovery,” as Andrew Lipsman of eMarketer put itduring a recent “Behind the Numbers” podcast. But right now, nobody is going shopping for sheer discovery. People are going shopping with a purpose or out of necessity. Shoppers want to be in and out as quickly as possible. Also, most malls are indoors and people are trying to avoid that type of atmosphere. Outdoor malls might offer a little more appeal, but shopping as a past-time is just not as fun to some as it used to be. Some people feel that the burden of the new guidelines and sanitary measures cancel out the benefits of “retail therapy.”

Another problematic issue with malls lies within the status of the big department “anchor” stores. The top two anchor stores for malls in the US are Macy’s and JC Penney. If those stores go bust, the entire mall is done. And those stores are walking a very fine line right now. Macy’s lost $1 billion in Q2, which is equivalent to their entire 2019 profit. JC Penney recently declared bankruptcy, along with other mall staples Neiman Marcus and Stage stores. Every mall store closing, even the small stores, give consumers less of a reason to shop there.

So malls might be done for, but can other brick-and-mortar stores really be saved? Perhaps. The answer lies with how and when consumers will feel comfortable going back into stores. Americans are still apprehensive, but there is pent-up demand, which may work in retailers’ favor.

The Harris Poll conducted a study in the US on behalf of Fast, an ecommerce payment option, at the end of April. The survey found that 89% of shoppers have concerns about shopping in physical stores, with just 11% saying they are not concerned. 63% said their top concern regarding shopping in stores is being too close to other people. 40% of survey participants listed store cleanliness as a top concern, while 34% cited touching credit card terminals, and 32% listed passing cash back and forth at the register.

Retailers know that they have to enact measures to make their customers and employees feel safe and comfortable shopping in-store. Some of the obvious, and maybe not so obvious, changes could possibly be:

- Masked, gloved employees and asking customers to wear masks, as well

- Plexiglass guards by cashiers

- Hand sanitizer stations

- Signs displaying checklist of what the store is doing to keep you safe or employees at the door explaining guidelines

- Reconfiguring of store layouts to create one-way traffic and more space between product shelves/racks

- Asking shoppers to social distance

- Stores being cleaned more often by people or cleaning robots

- Contactless payment options

- Self-checkout

- Click-and-collect options

- Reduced store hours

- Limiting the number of people coming into stores

- Temperature checks

- Appointment-only shopping

- Consulting with outside medical/health advisors

- Quarantine for items after they have been tried on in-store or returned before they return to the floor

Taking these steps could theoretically help stores attract more foot-traffic, which would signify consumers’ confidence in the health aspect of returning. However, retailers still need to understand that many Americans are still struggling economically, having lost their jobs or having reduced spending income. So there may be some lag time between store traffic returning and sales actually increasing. But, it is a step in the right direction.

Also, retailers may have to find a way to make sure some of these measures don’t deter people altogether. For example, the one-way traffic may be off-putting for some. What if you forget or miss an item you were looking for? Do you have to completely exit and re-enter or will you be able to turn back at all?

And what about fitting rooms? Some shoppers may feel completely uncomfortable with the idea of trying on anything in the store, but they may also be the shoppers who will only purchase something IF they have tried it on first. Maybe an employee constantly sanitizing the fitting rooms will be another new change.

We could probably go on and on about all the possibilities and what ifs and pros and cons of each scenario. Many people might just find it easier and safer to continually turn to ecommerce. But eventually, consumers may find themselves ready to enter stores. We can all speculate, but it simply may be just a matter of time and outside circumstances.