By now, we have all seen which types of businesses are best-suited to surviving the pandemic and which types of businesses are hanging by a thread. Of course there are exceptions to this based on the category of the business, but overall it seems like small businesses are struggling while the big businesses just keep getting bigger.

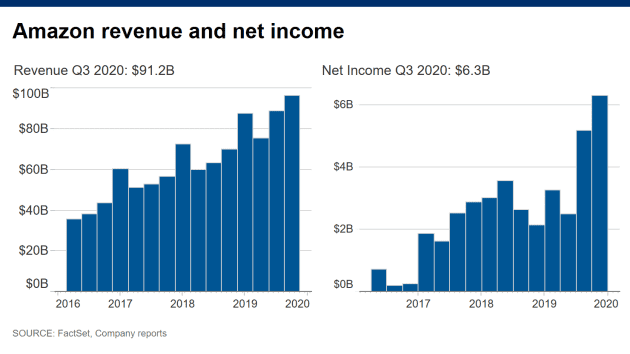

Perhaps the most notable example of this is Amazon. Just when you think they can’t possibly generate any more revenue, they continue to shatter records with each passing quarter this year. In Q3 alone, the retail giant reported a 37% jump in revenue leaving them with a $6.3 billion profit – their highest ever. And Q3 was expected to dip between height of lockdown Q2 and holiday Q4. Q3 didn’t even include Prime Day to help boost sales, which it normally does. Amazon has experienced such tremendous growth this year that they’ve had to hire 400,000 more employees, making it the second largest employer in the US after Walmart.

We’ve spoken about how e-commerce is at an all-time high. Again, this is in large part due to the pandemic, but it was also the trend beginning before COVID. So a big part of Amazon’s profit is from sheer product sales. One plus side to this is that Amazon claims its windfall is also helping small and medium businesses that sell their products on the platform. Those online sellers brought in nearly $5 billion between Black Friday and Cyber Monday on Amazon — a 60% increase from last year. Amazon has been regularly criticized for destroying these types of businesses, so it’s nice to see this halo effect.

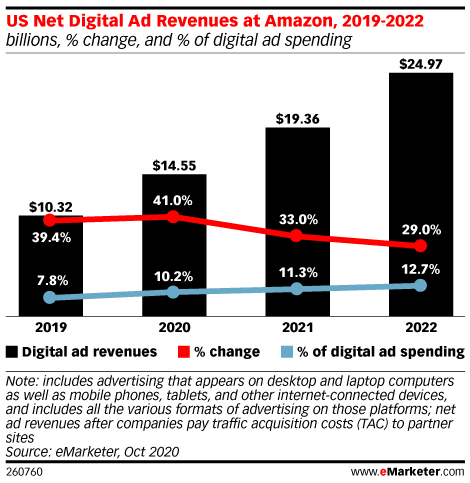

But, as a result of all this success, we’re also seeing huge growth in Amazon’s ad sales. The events of 2020 have made it clear that Amazon is positioned to continue growing its ad business robustly.

The growth rate of Amazon’s ad business accelerated to 51% in Q3, making ad sales revenue $5.4 billion. This part of their company is becoming much more profitable than most people realize.

For advertisers with goods to sell in the marketplace, Amazon ads have been a key performance lever this year, especially with the cheap ad opportunities available in Q2. Amazon advertising has long been a must for marketplace participants, and that hasn’t really changed—though more brands and retailers are considering Amazon from an e-commerce perspective due to the pandemic.

Amazon is continuing to roll out new ad products too, including more ways for advertisers to use video and other opportunities for advertising higher in the funnel. Sponsored Brands Video attracted about a quarter of its clients’ Sponsored Brand ad spending in Q3 2020, according to ad agency Tinuiti. Amazon is also working to offer more measurement tools to press its advantage as targeting- and attribution-related data becomes harder to come by.

Moreover, consumers are OK with what Amazon is doing with their ads. “For the most part, consumers are fine with the ad experience on Amazon—despite the fact that sponsored listings and other non-organic results continue to take up ever more real estate on the first search results page,” said Nicole Perrin, eMarketer principal analyst at Insider Intelligence. This is highly important considering 53% of US adults said they begin product searches at Amazon when planning to make a digital purchase. It is the first place many consumers check.

Q4 is bound to be astronomical for Amazon and that will surely be reflected in the ad sales figures. Net US digital ad revenues will rise by 41.0% this year as consumers dramatically shift to more ecommerce shopping and advertisers pay to get in front of shoppers at their leading destination.