As school and government officials scramble to figure out what the upcoming school year will look like, retailers are scrambling to make the most of the back to school shopping season. No doubt, with anxiety running high and uncertainty surrounding the fall months, it will look quite different than years past. Certain categories and timing of sales will most likely be affected. Yet, the outlook may not be as bad as some would predict.

The annual “Deloitte Back-to School Survey” and “Deloitte Back-to-College Survey” revealed some valuable insight into the mindsets of parents and students as they head into the next few months. Typically, the back to school shopping season has been the longest shopping season of the year, lasting from June through September, which currently puts us right in the midst of that timeframe.

So what are the stats? For starters, although many families have financial concerns due to the pandemic, overall back to school spending will remain relatively flat compared to last year. Students will still need supplies, whether they are physically in school or not. It is estimated that $28.1 billion will be spent for K-12 students, or approximately $529 per student and $25.4 billion will be spent for college students, or approximately $1,345 per student.

First and foremost, hygiene will obviously be at the top of mind for anyone going back into a school setting. Parents plan to allocate budget for personal health products, spending an average of $46 per student on supplies like face masks, sanitizer and wipes. Retailers should focus on keeping those supplies just as stocked and competitively priced as pencils and notebooks.

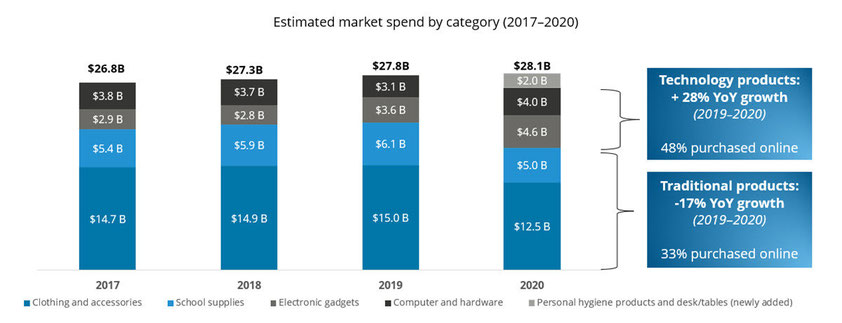

Estimated market spend for K-12

One of the most noteworthy findings from the chart above is the increased emphasis on technology-based learning tools. This is not surprising, however, considering the possibility of partial or full-time virtual learning for the next school year. Rod Sides, vice chairman, Deloitte LLP, summed it up well, saying, “With school formats still up in the air for many, the spend is shifting to tech as parents anticipate the possibility of remote learning and the need to supplement students’ education. Retailers that can stay nimble and react quickly to changing needs for education amid the challenges of COVID-19, will likely be the ones that will have an opportunity to appeal shoppers this season.”

Spending on technology products (including personal computers, smartphones, tablets, wearables) is set to increase 28% over 2019. Consumers planning to purchase these items intend to spend an average of $488 on them. And more than half (51%) of parents plan to increase their spend on virtual learning tools. In fact, 40% of parents plan to subscribe their children to a supplementary e-learning platform. These subscriptions may even begin over the summer, since many camps are closed and parents want to keep their kids busy.

Furthermore, children have an even greater influence over purchasing decisions with 69% exerting a moderate-to-high influence over computer and hardware purchases this year, up from 54% last year. I find this jump interesting and wonder if it’s a result of the increased amount of time parents and children have been spending living and working together. Family members are in tune with each other in recognizing new tech needs.

As for clothing, accessories and traditional school supplies – they dropped by 17%, but that category remains the largest portion of back-to-school spending, with K-12 parents planning on spending, on average, $336. But that is still a considerable hit to the traditional retailers. Spending on traditional back-to-school items like notebooks and backpacks is expected to be down 18% year-over-year, the survey said. There may be other specific items that will not need to be purchased if there is no in-school learning, such as uniforms or dress code apparel. On the other hand, there may be an increase in the amount of money families will invest into a “home office/classroom,” buying desks and other furniture.

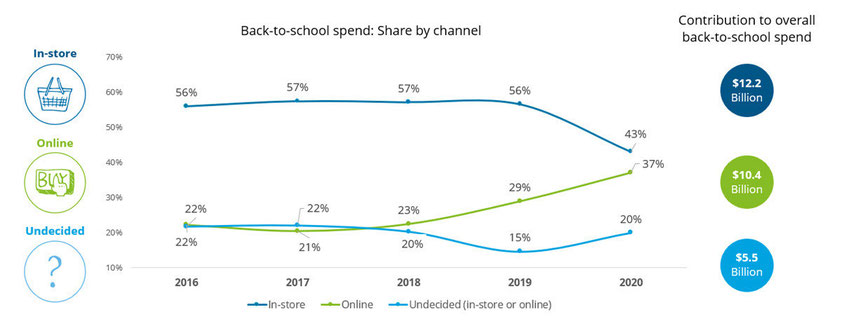

With health concerns rising, more back-to-school purchases will occur online (37%, up from 29% in 2019), gaining share from in-store purchases (43%). Consumers plan to spend $10.4 billion online this back-to-school season, up from $8.1 billion last year. Despite in-store spending projected to decline from $15.7 billion last year to $12.2 billion this year, the physical store remains critical with 43% of total spending projected to take place in-store. In fact, as consumers shift to contactless formats, 26% of shoppers plan to use BOPIS more frequently.

As with years past, mass merchants are the preferred shopping location for back-to-school shopping (81%), but they may lose some share this year as more people expect to shop closer to home because of the pandemic. When selecting where to shop, price (82%) and convenience (80%) remain the most important criteria for back-to-school shoppers, but safety (59%) is an important consideration for parents this year.

Despite the uncertainty on when and how schools will open, about 40% of respondents intend to start their school shopping four to six weeks before school begins, with late July and early August being the busiest — accounting for $16.2 billion in seasonal spending.

However, according to Deloitte’s survey, as of a few weeks ago, 43% of parents said they had yet to receive any communication from their children’s current schools about the safety precautions planned for the fall. Roughly a quarter still didn’t know when the first day of school is going to be. This uncertainty might cause parents to wait until later in the season to make their purchases, when there is an official plan laid out.

College students are also faced with great uncertainty as they weigh the value of education that they will receive during the COVID-19 era, especially as many colleges and universities are still determining how school will reopen in the fall. Faced with concerns over their family’s health, finances and the unknowns of campus life, parents of college-age children still plan to maintain spending in anticipation of a return to campus. Twenty-eight percent of parents may shift plans and have their students join online only institutions this fall; 29% may look to change plans and have their child live at home.

I think the important thing for retailers to realize is that the return to school could look very different across the country, depending on where COVID outbreaks are happening. Yet overall, we should see strong showings for stores like Best Buy, Walmart and Target that are known for their wide assortments of tech devices. Meanwhile, a lack of apparel spending could hurt department stores and other mall-based chains like Gap Inc., which owns Old Navy. But, as we mentioned earlier, the timing of events may be important. If school shopping starts later in the season or is drawn out, the spending may roll retailers right into the holiday shopping season.