Out-of-home advertising. Also known as OOH advertising, outdoor advertising, out-of-home media or outdoor media. It’s those roadside billboards, bus wraps, mall kiosks, even skywriting. We see it when we are on the go, in public places, in transit, in waiting rooms and in commercial locations. The list of out-of-home advertising options is quite lengthy.

We all know that this type of advertising is marketed to consumers when they are outside their homes. Cool. But hey, what happens to out-of-home advertising when we are all spending so much time inside our homes?

Covid has, of course, put a damper on it. Places like Times Square, with its OOH advertising to the max, is practically empty by normal standards. Many office workers are WFH indefinitely, tourism is waaay down, and it’s a similar situation in many of the big cities. So there are less eyes on giant billboards, less eyes on ads in subways and on buses, on digital displays in elevators and office buildings, airports, sporting arenas and on and on and on.

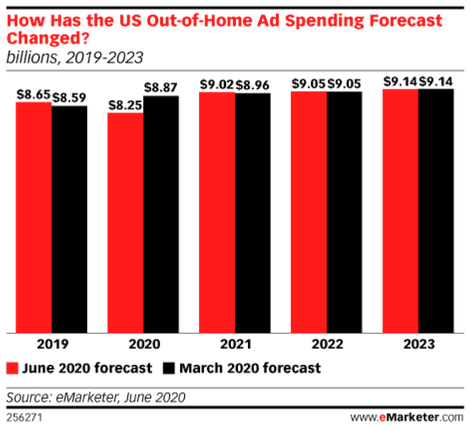

Pre-pandeminc, in early March, eMarketer expected the US total OOH ad spending would increase by 3.3% in 2020. Based on what they now know from the first half of the year, they now forecast that it will decline 4.6% this year – from $8.87 billion to $8.25 billion.

This decline doesn’t seem as bad as it should be considering how much time we actually spent in quarantine. However, there are a few factors that helped the dip from going too low.

Dollars for OOH are often committed weeks to a whole quarter in advance and Q1 was actually up since many of those buys were made in December. In Q2, we did see a huge decline, but the major effects weren’t really seen until May and June. As long as normal activities resume, analysts expect the second half of the year to be better thanks to the election in Q4 and pent up demand from earlier in the year. The good news is many advertisers who had plans for Q2 shifted their buys to later in the year instead of canceling altogether. This also allowed them to secure the best inventory around the holiday season.

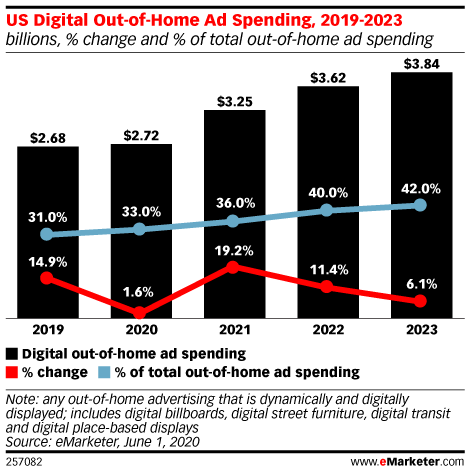

The numbers are set to rebounding next year, again, due to pent up demand and also because OOH was growing over the past several years to begin with. The growth is due in large part to OOH becoming more digital.

About one third of all OOH spending is digital. Last year, it grew nearly 15%, but this year only 1.6% due to the pandemic. It is, however, set to bounce up 19.2% next year, as things hopefully return to normal.

There are benefits to digital displays, even just the simple fact that they look brighter and more modern. And the companies, like Clear Channel and Lamar, that own these boards can cycle through more creative in a shorter amount of time. Yet, it’s not always practical to convert billboards to digital in sparsely populated areas because it is costly and time-consuming. It just doesn’t seem worth it outside of large cities. Also, some advertisers actually prefer the old school style of billboards because then their ads stay static and they have exclusivity on that board. So, while digital is expected to grow, it may never account for the majority of total OOH.

Within the realm of digital out-of-home (DOOH), programmatic is emerging. It is increasing, even amid the pandemic, but it is still experimental. This year it’s 2.2% of all OOH and 6.7% of all digital out-of-home. US programmatic DOOH ad spending will more than double from 2019, totaling $181.6 million. That figure will reach $533.8 million by 2022.

Programmatic has been slower to catch on in OOH than in other media. Much of the growth is dependent on the number of digital screens that become available. It’s just not bought and sold the same way and it’s still pretty pricey. There’s also very finite inventory. While programmatic buying makes it easier for ad campaigns to be adjusted on the fly, the way data is used for targeting digital outdoor ads differs from how users are targeted online. It’s not real-time bidding. Also, OOH is still a one-to-many medium, so it doesn’t offer one-to-one targeting like online advertising.

Yet, the way that programmatic DOOH works is interesting. A campaign can be set so that inventory is programmatically purchased whenever certain conditions are met. EMarketer’s Ross Benes offered examples in a recently written article:

- The Campbell Soup Company bought outdoor inventory programmatically when the weather dropped below a certain temperature.

- The nasal spray brand Flonase programmatically purchased OOH inventory when pollen levels rose in certain geographic areas.

- Pernod Ricard uses triggers like happy hour times and temperatures to determine when to programmatically purchase outdoor inventory for its alcohol brands.

And what about sports arenas now that sports are back and televised, but fans are not? Much of the regular advertising is back and visible to viewers. Some MLB teams have also been placing ads on pitchers mounds and branding tarps that are covering parts of the stadiums. With the NBA, there are more logos on the court than ever before.

There is a lot of optimism heading into H2. Sure, there could possibly be spikes of the virus, but hopefully not to the point where we would be faced with the strict lockdowns we endured in the spring. The situation should be a lot better. Already, miles traveled are going back up, reaching almost the same levels as pre-pandemic. Economic activity and spending should resume. There will still be places that won’t have the same amount of foot traffic as before, like the subway and office buildings. So perhaps the best advice to advertisers is to use data to see where foot traffic still is. Maybe it‘s the same locations you’ve always targeted and maybe it’s not. You have to think about new opportunities based on the way our world has changed. There are now people waiting on lines outside of stores and outdoor dining in the streets. Maybe theses are the new types of chances to make your mark.